Financial Coaching

Financial coaching is about so much more than your budget.

It’s about living your life on your terms

We believe coaching leads to a strong financial plan that can serve as a roadmap in helping clients establish a clear path toward achieving their goals.

Defining your money psychology

Your money mindset influences your financial decisions, your spending habits, and your savings goals. This mindset can be positive or negative, abundant, scarce, empowering or limiting. Money and values are not always aligned. You can develop a healthier and happier relationship with money by becoming more aware of your beliefs, emotions, and behaviors.

It’s important to have a clear sense of your values and how they relate to money, so that you that you will not feel pressured to spend money on things that don’t match your values. Now you’re making better financial decisions that support your well-being and happiness.

It’s more than just the numbers, it’s creating a personalized plan around your values and your goals.

Creating a Plan:

- Define your WHY/Motivation

- Managing your income

- Strategize to reduce and pay off your debt

- Save Money

- Build Wealth

Improving your financial fitness

Improving your financial fitness is a goal people share, but it can be challenging to achieve without financial discipline. Financial discipline means having a clear plan for your income and expenses, setting realistic and measurable goals, and sticking to them. This also means avoiding unnecessary debt, saving for emergencies and retirement, and investing wisely in yourself and your goals. By practicing financial discipline, you can improve your financial fitness and enjoy the benefits of financial security and freedom.

Ready?

Schedule a consultation today with Wendy Healy.

Savings

Emergency fund: helps you cover unexpected expenses like medical bills, car repairs, or job loss. An emergency fund should have enough money to cover three to six months of your essential living expenses. By having an emergency fund, you can be more prepared for whatever life throws at you.

Sinking Funds: for larger financial needs another useful tool is a sinking fund. A sinking fund is a specific amount of money you set aside for a goal or expense that you know is coming up in the future. For example, you can have a sinking fund for a down payment on a house, a new car, annual car insurance, your holiday gifts, or your home maintenance. A sinking fund helps you avoid going into debt or dipping into your emergency fund for these planned expenses.

Spending

Do you know the difference between spending on wants and needs? It’s easy to mix the two, especially when your income grows and your lifestyle changes. This is called lifestyle creep and it can be dangerous for your financial health. You might think you deserve to treat yourself, but you end up living paycheck to paycheck or worse, in debt.

Be mindful of your spending habits and set realistic goals for your future. Spend on what is important to you and what you value without compromising your financial health or goals.

Managing debt

Managing debt can be stressful, but it doesn’t have to be overwhelming.

Getting out of debt is one of the best things you can do for yourself and your future. Debt can be a huge burden that affects your mental health, relationships, and ability to achieve your goals. When you are debt-free you have more freedom, peace of mind, and opportunities to grow your wealth and happiness. Take action now. Pay off your debt as soon as possible so you can live your best life.

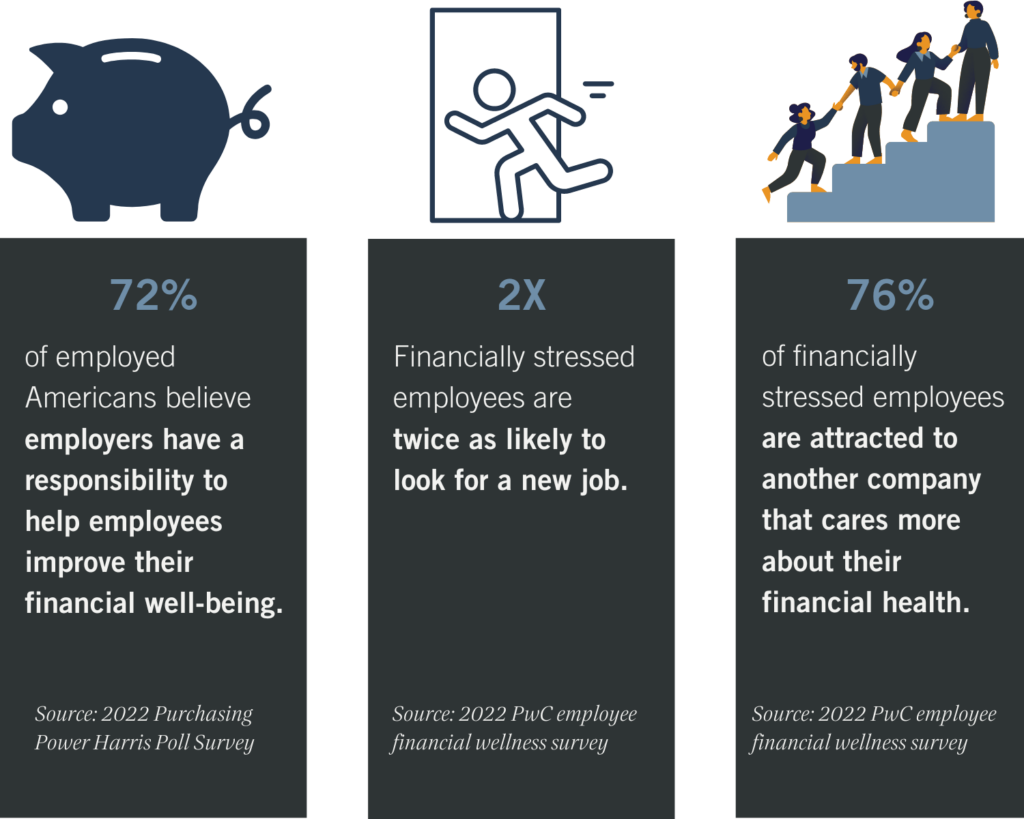

Wealthwi$e™ Employee Program:

We know that you’re trying to support your team. But the truth is that a paycheck alone doesn’t guarantee workers financial stability in today’s environment. Like it or not, your team is looking to you to close the gap.

Help your employees achieve financial wellness and unlock their true potential with an Employee Wellness Program. We offer a unique approach to financial coaching, helping your employees build a strong financial foundation.

Our employee wellness programs are based on the following principles:

- Financial coaching tailored to your team, covering topics such as money management, budgeting, saving, and debt management.

- Creating actionable and realistic spending plans that align with your employees’ goals and values.

- Ongoing support and guidance to help your employees stay on track, overcome challenges, and celebrate successes.

Our employee wellness programs are beneficial for both employees and employers. You can reduce stress, turnover, and increase productivity by investing in your team’s financial wellness.

Don’t wait any longer. Contact us today to achieve financial wellness and success.

Ready?

Schedule a consultation today with Wendy Healy.